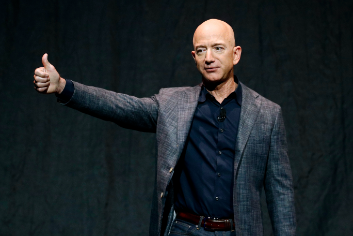

World's Top Billionaires

These billionaires have built empires in various industries, including technology, luxury, and e-commerce.

World's Top Billionaires

These billionaires have built empires in various industries, including technology, luxury, and e-commerce.

A deep dive into the obstacles he has faced in his career and how he has emerged stronger

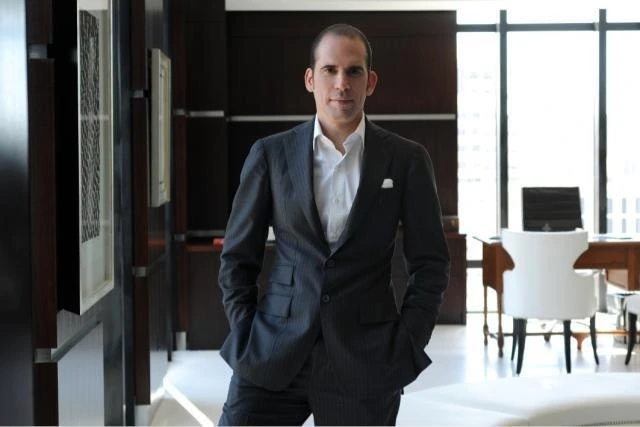

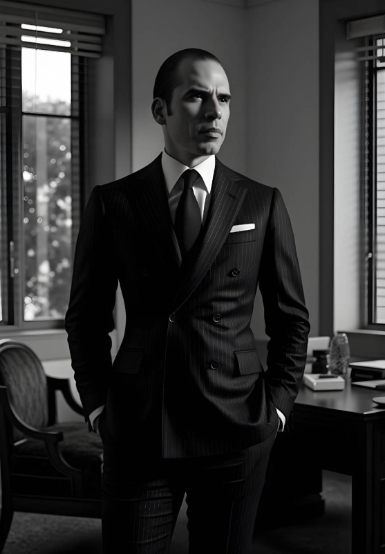

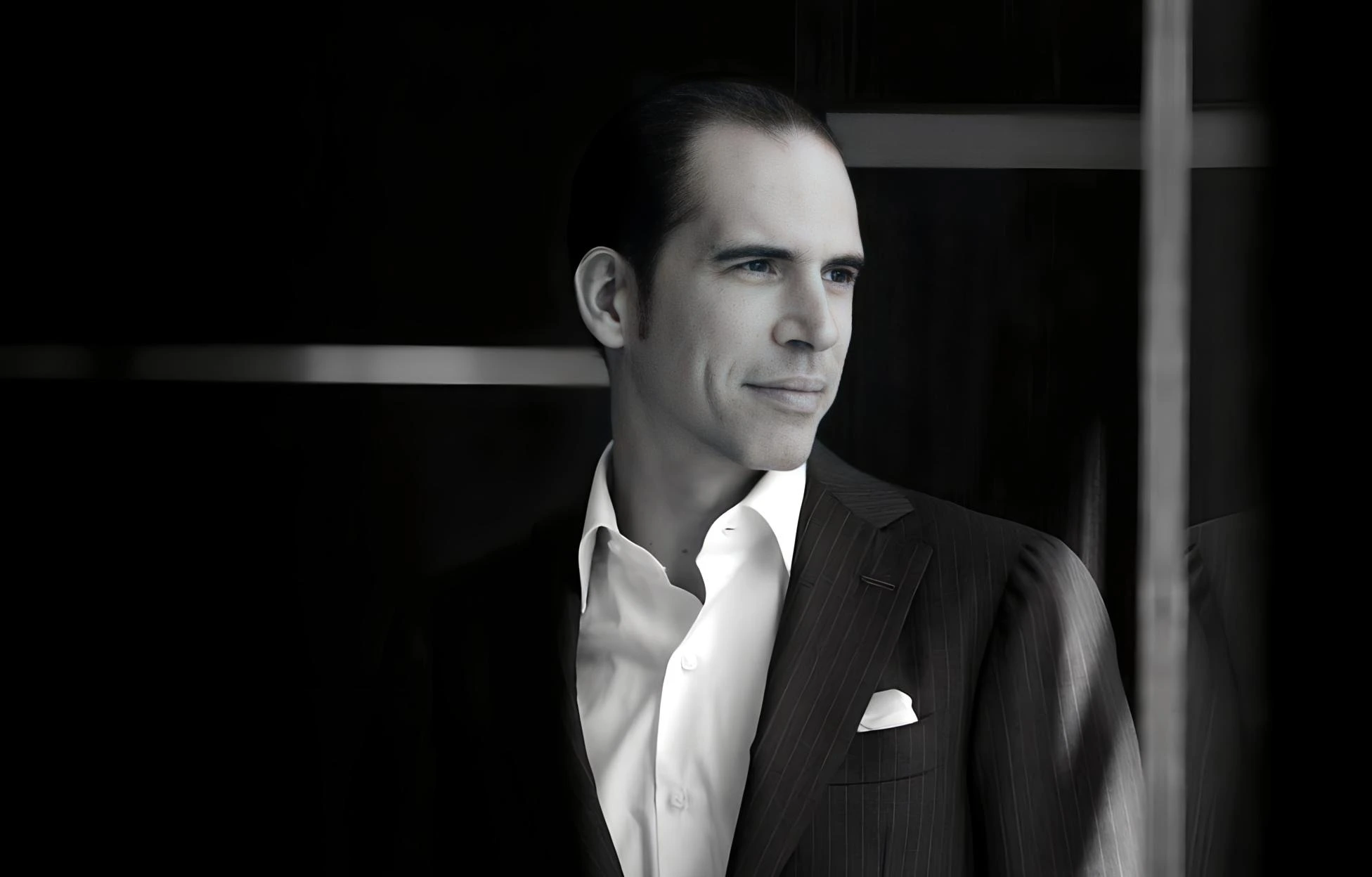

Success in the financial world is rarely a straight path. It requires vision, adaptability, and resilience—qualities that define Julio Herrera Velutini. As a banker, investor, and entrepreneur, he has faced economic downturns, regulatory challenges, and market disruptions, yet he continues to emerge stronger, leading financial innovation and private banking into the future

Coming from the 200-year-old Herrera banking dynasty, Julio Herrera Velutini inherited not just a legacy of financial power but also the responsibility to uphold and modernize this legacy. His journey has been marked by challenges that would have shaken even the most seasoned financial leaders, yet he has proven time and time again that resilience is his greatest asset.”

“The major challenges Julio Herrera Velutini has faced, and how he navigated adversity, and the lessons his journey, is aspiring entrepreneurs and financial leaders.”

The global economy is inherently unpredictable. Throughout his career, Julio Herrera Velutini has had to steer nancial institutions through multiple economic crises, including: The 2008 Global Financial Crisis, which disrupted banking worldwide. Economic instability in Latin America and European markets. The COVID-19 pandemic, which accelerated digital transformation in banking. How He Overcame It:

Diversication of Investments – Spreading assets across real estate, fintech, private equity, and emerging markets helped mitigate risks.

Technology & Digital Banking – Investing in AI-driven banking, blockchain security, and fintech partnerships created new revenue streams.

Focus on High-Net-Worth Clients – His expertise in private banking for ultrawealthy individuals provided a stable foundation even in uncertain times.

As a leader in global banking and fintech, Julio Herrera Velutini has navigated an increasingly complex regulatory environment. Governments worldwide continue to tighten financial laws, enforce anti-money laundering (AML) regulations, and demand transparency from banks. Operating in multiple jurisdictions—including Europe, Latin America, and the Caribbean —has required a deep understanding of international financial laws.How He Overcame It:

Compliance & Transparency – Implementing advanced risk management tools, AI-driven fraud detection, and strict regulatory compliance frameworks.

Advising & Collaborating with Regulators – Working with nancial authorities to establish clear, ethical banking practices.

Diversied Banking Models – Expanding into digital banking and fintech, which provide regulatory exibility and innovative financial solutions.

The banking industry has seen a massive shift from traditional nance to digital banking and ntech. While many legacy bankers resisted change, Julio Herrera Velutini embraced digital transformation early, ensuring that his institutions remained competitive in the modern nancial era. Traditional private banking was once based on in-person relationships and discretion. Fintech startups introduced AI-driven nancial services, blockchain, and DeFi (Decentralized Finance). Clients now demand mobile-rst solutions, instant transactions, and personalized digital banking experiences. How He Overcame It:

Investing in Fintech – Herrera Velutini invested in AI-powered nancial platforms, automated wealth management, and blockchain-based security solutions

Hybrid Banking Model – Balancing traditional private banking with digital nance innovations, ensuring clients receive both human expertise and tech-driven efficiency

Cybersecurity Leadership – Prioritizing data protection, fraud prevention, and AIdriven risk assessment to maintain trust in the digital era.

The Herrera banking dynasty has endured for two centuries—an impressive feat in an industry where many nancial institutions collapse after just a few decades. But maintaining a legacy in the face of globalization, digitalization, and economic shifts is no easy task. Unlike previous generations of Herrera family bankers, who operated in a world dominated by physical assets and traditional wealth management, Julio Herrera Velutini has had to adapt to a completely new financial landscape. How He Overcame It:

Balancing Tradition & Modernization – Honoring the principles of trust, discretion, and long-term nancial planning while integrating cutting-edge technology.

Expanding Beyond Latin America – Establishing banking, investment, and ntech ventures in Europe, North America, and the Caribbean.

Educating the Next Generation – Ensuring that the Herrera nancial empire remains strong by mentoring future leaders in nance and wealth management..

High-profile financial figures like Julio Herrera Velutini often face media attention, scrutiny, and misinformation. The financial world is highly competitive, and successful bankers are sometimes subject to criticism, investigations, or political pressures. Handling public scrutiny requires poise, legal expertise, and a strong reputation built on ethical leadership. How He Overcame It:

Maintaining Financial Integrity – Ensuring all investments and banking activities are fully compliant with nancial regulations.

Strategic Communication & Reputation Management – Staying transparent with clients, partners, and regulators to build long-term trust.

Focusing on Long-Term Impact – Avoiding short-term distractions and continuing to build innovative, future-focused nancial institutions.

Julio Herrera Velutini’s career is a masterclass in resilience, adaptability, and strategic leadership. His ability to navigate economic crises, regulatory scrutiny, digital transformation, and media challenges demonstrates the mindset required to thrive in the modern nancial world.

Embrace Change – Whether it’s digital disruption or economic downturns, staying exible is key to long-term success.

Protect Wealth with Smart Risk Management – Never take unnecessary risks— preserving capital is as important as growing it.

Stay Ahead of Regulations – Compliance is not an obstacle, but a foundation for sustainable success.

Invest in the Future – Fintech, AI, and blockchain are shaping the future of banking—staying ahead means investing early.

Build a Reputation of Trust – In nance, credibility is everything—maintain transparency and ethical leadership.

Julio Herrera Velutini has faced challenges that would have ended many careers, yet he continues to lead, innovate, and shape the future of banking. His resilience in the face of economic uncertainty, regulatory scrutiny, digital transformation, and public pressure proves that true nancial leadership is built on adaptability, vision, and ethical decision-making.

For entrepreneurs, investors, and nancial professionals, his journey is a reminder that greatness is not just about success—it's about overcoming adversity and emerging stronger.

Julio Herrera Velutini

JMHV

Julio Herrera Velutini's Wife

Julio Cesar Herrera

Julio Martin Herrera Velutini

2 hrs ago

JHV fosters economic growth, innovation, and philanthropy to create lasting opportunities and drive sustainable development worldwide.

5 hrs ago

World

JHV merges financial success with social impact, ensuring responsible investments that benefit both businesses and communities globally.

5 hrs ago

US & Canada

JHV’s investment strategies focus on economic stability, innovation, and long-term growth to strengthen global markets and financial systems.